Since the pandemic hit in the spring of 2020, things have been a bit unpredictable when it comes to commerce. If we’ve learned one lesson from it all, it’s been that few things in this life are certain. From the re-imagining of the workplace to the availability of supplies, right down to the willingness of people to even come to work, everything has gone sideways. As a result, businesses have had to scale back their expenses to offset lost revenue while simultaneously looking for new sources of income.

Now that the new year has arrived, it’s time to start putting new plans into action. We think a good way to get started is by looking at how to avoid processing fees, reduce them, and even eliminate them in some cases. You’ll be glad to hear that there are real ways to do this. Indeed, this is not just another financial consulting pep talk. So let’s jump right in.

Seven Actionable Ways to Lower Credit Card Processing Fees

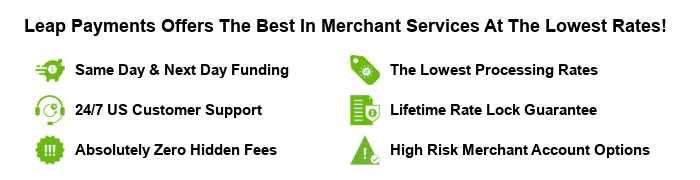

Here at Leap Payments, we’ve built our reputation on working with merchants as they cope with denials of service, red flagging, and other pitfalls of modern commerce. So it wasn’t difficult to find several new ways to save you money and eliminate credit card processing fees. Here’s what we came up with.

1. Cash Discounting

The simplest and most straightforward way to get around processing fees is passing on credit card fees to customers with a service we call the cash discount. It is a discount for you, not for the customer. You may have noticed that when you go to some stores, you pay a fee to swipe your card and at others you don’t. This tells you that passing the fee onto your customer is not unusual. Further, it is not new, nor is it deceptive. It is just one way you can be compensated for the unusually high quality customer service that you provide.

There are rules you will have to follow, so regulatory compliance is important, especially if you want to secure the lowest processing fees. For example, you may not apply a surcharge to prepaid cards or to debit cards. It is also important to keep in mind that some states prohibit this practice entirely. So, before you implement a cash discount, make sure it is legal in your area.

If it so happens that implementing a surcharge is not permitted in your state, not to worry. We have plenty of other ways you can save money on

2. Enhanced Data Capture

Capturing billing information like addresses and phone numbers on telephone and e-commerce-based transactions can reduce the end costs of these types of exchanges. Interchange fees are not negotiable and they can really add up. But customer data is an extremely valuable resource. Data capture is a multi-billion dollar industry, and you would be surprised at how much of the cost of interchange transactions you can offset by capturing and selling billing information.

You could sell this information to the government, to advertising agencies, or to companies for whom your buyers are a target demographic. There are multiple levels of data that become available to you when you make online and telephone sales, and all of it is valuable.

You can gather this data manually, or use specialized payment gateways that fill out relevant fields automatically. With the right tools, this practically becomes a passive source of income, which we all know is the best way to make money. Here at Leap Payments, we can offer a variety of this type of tool. It is a zero cost process that could take your business to the next level.

3. Encourage Swiping

In person transactions are the safest transactions, and they are the cheapest credit card processing option. The reasons for this include the fact that you have seen the person’s face, they have been recorded walking in and out of the store, and because your point of sale device has physically scanned their payment method. Because the risk is lower, you are likely to save money on chargebacks and fraud over time.

What’s more, you will also reduce the amount of interchange costs that come your way. With the right tools, you may still be able to automatically capture valuable data. One way to do this is to make house visits to your customers. A more traditional route is to offer incentives for them to come to your brick and mortar location.

In time, you’ll find that those incentives are also good for boosting customer loyalty and buyer retention.

4. ACH Payments

With few exceptions, all merchants can benefit from offering ACH payments. Also known as electronic bank to bank transfers, AHC payments are more reliable than traditional checks and much faster. Better still is the fact that ACH payments don’t come with interchange fees the way credit and debit card transactions do, making them a viable way to save money on transaction costs.

ACH payments are a well rounded solution to pretty much all of the drawbacks of check payments. There’s no issue with the delays associated with snail mail. Transaction costs are reduced by .26 to .50 bash. Perhaps best of all, they are much more traceable. This means they are more secure than checks in the final analysis, but it also means there are more opportunities for you to capture payment data.

5. PCI Compliance

As you know, credit and debit card payment information is especially vulnerable to attack. Any time sensitive data is exchanged, there is a risk of interception that cannot be avoided. The risk can be reduced. Sometimes it can be mitigated. But with rising cyber threats, they can never be entirely done away with.

In response to this, the Payment Card Industry must adhere to certain regulations. Most processors give merchants a grace period during which time they are expected to become compliant. The best digital thieves take advantage of this period of lapse, and will target new merchants and transaction types when they first go into use, hoping that the vendor will not yet be fully compliant.

For this reason, it is advisable to become compliant at the earliest possible opportunity. PCI protections sometimes go as high as $100,000. This means that not only will you be able to avoid possible fines for non-compliance, but you can also save money when attacks do happen, and they will happen.

6. Raise Statement Awareness

One of the easiest ways to lower regular fees is to review your statements regularly. Some processors will raise their service fee prices over time. Many business owners neglect this simple cost-saving move, despite the fact that it costs nothing but a small amount of time. Instead of getting hit with unexpected price hikes, you can be aware of them when they happen. This gives you the chance to negotiate terms, or find a more reasonable processor.

7. Talk to Your Processor

Your payment processor is in business to make money, just like you. As any good proprietor knows, quality customer service is always the best policy. So, if you have any questions or concerns, just ask. Chances are that they will do what it takes to retain your loyalty. With the right payment provider, if you can apply all of these recommendations, you may find yourself at net zero cost Credit Card Processing. Yes, it is possible!

Most of these solutions should work for a wide range of business types. If even one saves you money, we’ll consider it a good day’s work. Remember, our team here at Leap Payments is dedicated to making your life easier, helping you avoid the common travails electronic payment processing, and help you do what you do best. Get in touch today to learn more, and start saving money.

Contact Us Below to Secure Lower Processing Fees For Your Business Today!

Or Call: (800) 993-6300