When setting up a payments system for your business, it is important to do your research. Not only is it critical for you to get paid for your products and services, you also need to know how each potential option affects your bottom line. Interchange plus pricing and tiered or flat rate pricing both have their benefits, but it is also smart to understand how each works so you can make the best decision for your operation.

Interchange plus pricing is traditionally reserved for large companies and has the lowest possible costs for accepting cards as a form of payment. Fees applied to transactions are upfront, with rates determined on a per-card basis. Tiered pricing is the most common form of pricing for credit card processing services. This is also known as “bucket pricing,” and prices are usually high enough to cover fees.

Working with an experienced payment processer will allow your organization to find the payment and pricing solution that is best for your business.

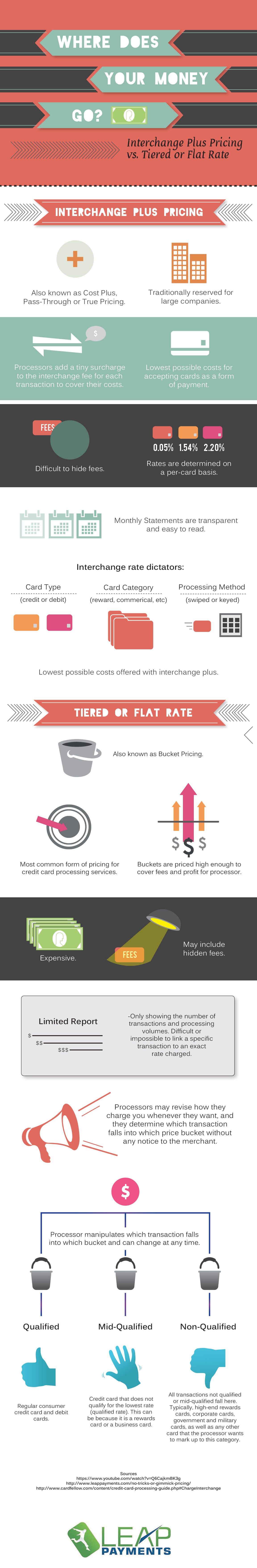

Where Does Your Money Go?

Interchange Plus Pricing vs. Tiered or Flat Rate

Interchange Plus Pricing

Also known as Cost Plus, Pass-Through or True Pricing and traditionally reserved for large companies. Processors add a tiny surcharge to the interchange fee for each transaction to cover their costs. Lowest possible costs for accepting cards as a form of payment.

Interchange Plus Fees

- Difficult to hide fees

- 0.05% 1.54% 2.20%

- Rates are determined on a per-card basis

Monthly Statements are transparent and easy to read.

Interchange Rate Dictators

- Card Type (credit or debit)

- Card Category (reward, commerical, etc)

- Processing Method (swiped or keyed)

Lowest possible costs offered with interchange plus.

Tired or Flat Rate Pricing

Also known as Bucket Pricing. Most common form of pricing for Buckets are priced high enough to credit card processing services. Buckets are priced high enough to cover fees and profit for processor.

Tired and Flat Rate Fees

- More expensive

- May include hidden fees

Limited Report

Only showing the number of transactions and processing volumes. Difficult or impossible to link a specific transaction to an exact rate charged. Processors may revise how they charge you whenever they want, and they determine which transaction falls into which price bucket without any notice to the merchant. Processor manipulates which transaction falls into which bucket and can change at any time.

|

Qualified Regular consumer credit card and debit cards. |

Mid-Qualified Non-Qualified Credit card that does not qualify for the lowest rate (qualified rate). This can be because it is a rewards card or a business card. |

Non-Qualified All transactions not qualified or mid-qualified fall here. Typically, high-end rewards cards, corporate cards, government and military cards, as well as any other card that the processor wants to mark up to this category. |

All transactions not qualified or mid-qualified fall here. Typically, high-end rewards cards, corporate cards, government and military cards, as well as any other card that the processor wants to mark up to this category.

Sources

https://www.youtube.com/watch?v=Q6CajkmBK3g

http://www.leappayments.com/no-tricks-or-gimmick-pricing/

http://www.cardfellow.com/content/credit-card-processing-guide.php#Chargelnterchange