Are your credit card processing rates increasing? Did you know that credit card processors can raise your rate at any time, even if you are in a contract? Over time, even small rate increases can add up and take a significant bite out of your profits.

As a merchant, your goal is to minimize your credit card processing costs and maximize your profitability. Leap Payments is the only company that offers you a guaranteed lifetime rate of lock. So, your rates will never increase. Our competitors typically offer a low teaser rate, and then steadily increase it over time.

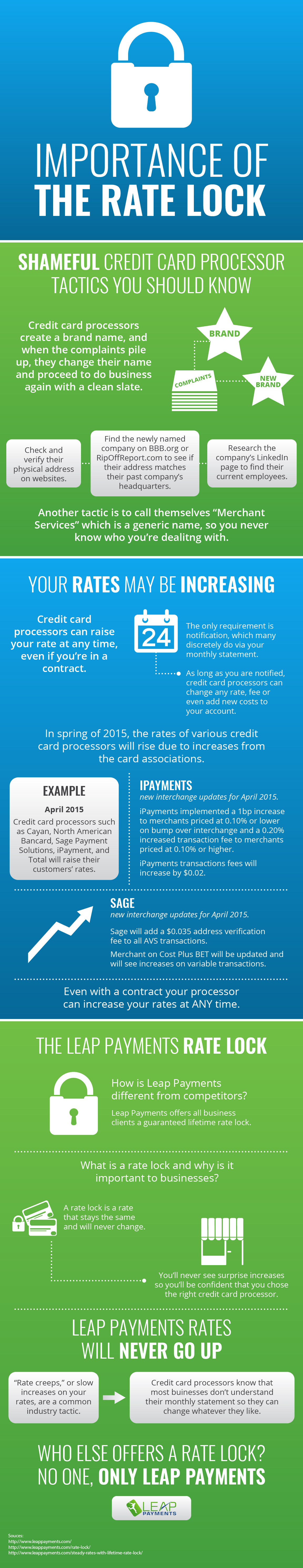

Leap Payments shows you the true interchange rate for each card that your business accepts. This rate reflects our actual costs. Our business philosophy is to fully disclose our fees rather than hiding them in the fine print. Please see the infographic below for more information about the Leap Payments rate lock and how to protect yourself against misleading tactics in the credit card processing industry.

The Importance Of Rate Lock

Shameful Credit Card Processor Tactics You Should Know

Credit card processors create a brand name, and when the complaints pile up, they change their name and proceed to do business again with a clean slate.

- Check and verify their physical address on websites.

- Find the newly named company on BBB.org or RipOffReport.com to see if their address matches their past company’s headquarters.

- Research the company’s LinkedIn page to find their current employees.

Another tactic is to call themselves “Merchant Services” which is a generic name, so you never know who you’re dealing with.

Your Rates May Be Increasing

Credit card processors can raise your rate at any time, even if you’re in a contract. The only requirement is notification, which many discretely do via your monthly statement. If you are notified, credit card processors can change any rate, fee or even add new costs to your account.

In spring of 2015, the rates of various credit card processors will rise due to increases from the card associations.

EXAMPLEApril 2015 Credit card processors such as Cayan, North American Bancard, Sage Payment Solutions, iPayment, and Total will raise their customers’ rates. |

iPAYMENTS– New interchange updates for April 2015 –iPayments implemented a lbp increase to merchants priced at 0.10% or lower on bump over interchange and a 0.20% increased transaction fee to merchants priced at 0.10% or higher.iPayments transactions fees will increase by $0.02. | SAGE– New interchange updates for April 2015 –Sage will add a $0.035 address verification fee to all AVS transactions.Merchant on Cost Plus BET will be updated and will see increases on variable transactions. |

Even with a contract your processor can increase your rates at ANY time.

The Leap Payments Rate Lock

How is Leap Payments different from competitors?

Leap Payments offers all business clients a guaranteed lifetime rate lock.

What is a rate lock and why is it important to businesses?

- A rate lock is a rate that stays the same and will never change.

- You’ll never see surprise increases so you’ll be confident that you chose the right credit card processor.

Leap Payments Rates Will Never Go Up

“Rate creeps,” or slow increases on your rates, are a common industry tactic. Credit card processors know that most businesses don’t understand their monthly statement, so they can change whatever they like.

Who Else Offers A Rate Lock? No One, Only Leap Payments

Sources:

http://www.leappayments.com/

http://www.leappayments.com/rate-lock/

http://www.leappayments.com/steady-rates-with-lifetime-rate-lock/