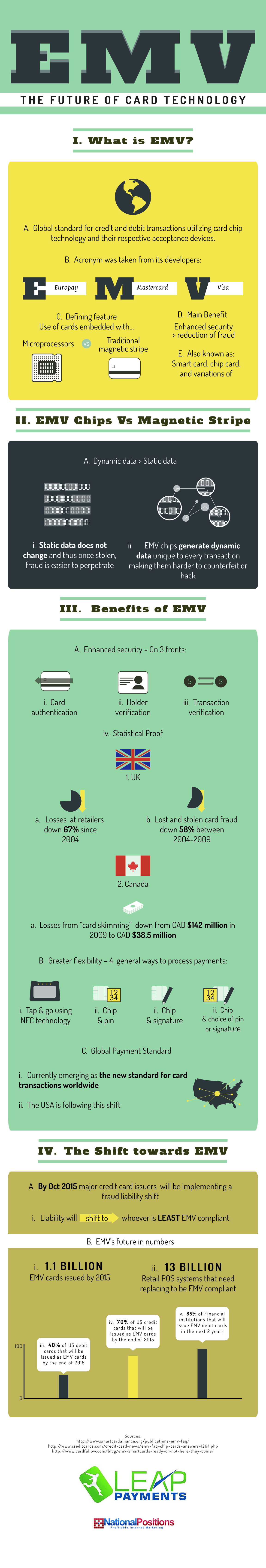

It may seem at times that not a month goes by without a security breach that leads to credit card numbers being exposed to hackers. When it comes to consumer and business protection, being able to securely complete transactions and eliminate fraud are paramount. In an effort to achieve these goals, EMV (Europay, MasterCard, Visa) Card Technology is being developed as a stronger alternative to magnetic stripe cards used in the United States today.

EMV is a global standard for credit and debit transactions that uses a chip embedded in the card to verify the identity of a customer. Whereas magnetic stripe cards contain static data tied to the card number that can be easily replicated by fraudsters, EMV chips generate dynamic data that is unique to each transaction. Payments are processed in four general ways:

- Tap & Go, with NFC technology

- Chip & PIN, where a customer enters a PIN after the card has been accepted

- Chip & Signature

- Chip & Either PIN or Signature

The shift toward EMV adoption is underway in the United States, and 1.1 billion such cards are expected to be issued by 2015. Learn more about the transition and how it affects your business today.

The Future of Card Technology

1) What is EMV?

Global standard for credit and debit transactions utilizing card chip technology and their respective acceptance devices.

- Acronym was taken from its developers:

- E uropay

- M astercard

- V isa

- Use of Defining feature cards embedded with…

- Microprocessors VS Traditional magnetic stripe

- Main Benefit

- Enhanced security > reduction of fraud

- Also known as:

- Smart card

- Chip card

- Other variations

2) EMV Chips Vs Magnetic Stripe

- Dynamic data > Static data

- Static data does not change and thus once stolen, fraud is easier to perpetrate

- EMV chips generate dynamic data unique to every transaction making them harder to counterfeit or hack

3) Benefits of EMV Chip Card

- Enhanced security – On 3 fronts:

- Card authentication

- Holder verification

- Transaction verification

- Statistical Proof

- UK

- Losses at retailers down 67% since 2004

- Lost and stolen card Fraud down 58% between 2004-2009

- Canada

- Losses from “card skimming” down from CAD $142 million in 2009 to CAD $38.5 million

- UK

- Greater flexibility – 4 general ways to process payments:

- Tap & go using NFC technology

- Chip & pin

- Chip & signature

- Chip & choice of pin or signature

- Global Payment Standard

- Currently emerging as the new standard for card transactions worldwide -.11194110N

- The USA is following this shift

4) The Shift towards EMV

- By Oct 2015 major credit card issuers will be implementing a fraud liability shift

- Liability will shift to whoever is LEAST EMV compliant

- EMV’s future in numbers

- 1 BILLION EMV cards issued by 2015

- 13 BILLION Retail POS systems that need replacing to be EMV compliant

- 40% of US debit cards that will be issued as EMV cards by the end of 2 015

- 70% of US credit cards that will be issued as EMV cards by the end of 2 015

- 85% of Financial institutions that will issue EMV debit cards in the next 2 years

Sources:

http://www.smartcardalliance.org/publications-emv-faq/

http://www.creditcards.com/credit-card-news/emv-faq-chip-cards-answers-1264.php

http://www.cardfellow.com/blog/emv-smartcards-ready-or-not-here-they-come/