For small business owners, every dollar counts. Yet, thousands slip away each year through hidden payment processing fees—sneaky charges buried in fine print or disguised as routine costs. Whether you’re running a retail shop, an e-commerce platform, or a service business, these fees can quietly erode your margins, especially in 2025’s inflationary economy. The good news? By knowing what to look for and how to fight back, you can keep more of your hard-earned revenue. Here are five hidden fees draining your business and practical steps to avoid them

The Hidden Processing Fee Trap

Payment processors like Square or PayPal often advertise “simple” rates—2.6-2.9% per transaction sounds straightforward. But dig deeper, and you’ll find extra charges that add up fast. From PCI compliance fees to chargeback penalties, these costs hit small businesses hardest, where margins are already tight. Understanding these traps is the first step to reclaiming your profits.

1. PCI Compliance Fees

Every year, processors slip in a charge—often $50 to $150—for ensuring your business meets Payment Card Industry Data Security Standards (PCI DSS), a critical safeguard against data breaches. The sting comes when you’re billed even if your systems are compliant, or worse, when the fee feels like a tax for simply accepting cards. For a small shop scraping by, that $99 hit is money not spent on inventory or marketing, piling unnecessary overhead onto your already tight budget.

How to Avoid: Ask your processor if PCI fees are mandatory or bundled into rates. Some waive them with compliant setups. Better yet, choose a provider with transparent pricing that includes compliance support.

Pro Tip: Complete PCI self-assessments (often free online) to prove compliance and push back on unnecessary charges.

2. Chargeback Fees

When a customer disputes a transaction, processors don’t just refund the sale—they slap on a $15 to $50 fee per incident, whether you win the dispute or not. For a business with even a handful of chargebacks—say, five a month at $25 each—that’s $1,500 a year, plus the lost revenue from the sale itself. These fees punish small merchants disproportionately, turning routine customer disagreements into costly setbacks that chip away at your bottom line.

How to Avoid: Invest in fraud prevention tools (e.g., AI-driven alerts) to catch issues early. Use clear billing descriptors (e.g., “Joe’s Coffee Shop”) to avoid confusion-driven disputes. Negotiate with your processor to lower or cap chargeback fees, especially if you have a low dispute rate.

3. Statement or Service Fees

Tucked into your monthly statement, you’ll often find vague “administrative” charges—$5 to $25—for account maintenance, paper statements, or even customer service access. These fees, sometimes labeled as “miscellaneous,” seem small but add up to $120 a year for a single $10 monthly charge. For multi-location businesses, the cost multiplies, draining funds that could fuel growth or cover rising 2025 supply costs.

How to Avoid: Scrutinize statements for vague line items—question every charge. Opt for processors with all-inclusive pricing or no monthly minimums. If you’re hit with these, push for a waiver, especially if you process high volumes.

Pro Tip: Go paperless for statements to dodge “printing” fees some processors sneak in.

Check Out Just A Few of The Companies That Trust & Use Leap Payments

4. Gateway or Transaction Fees

Online or mobile payments often come with extra per-transaction charges—$0.05 to $0.25—or monthly gateway fees of $10 to $50 for using e-commerce platforms or POS systems. At $0.10 per transaction, a shop with 1,000 monthly sales loses $1,200 a year on top of percentage fees, a silent hit that’s especially brutal for e-commerce merchants already juggling thin margins.

How to Avoid: Choose a processor with integrated gateways included in the rate. Compare flat-rate vs. interchange-plus pricing; the latter often skips add-ons. Ask upfront about gateway costs before signing. For in-store, look for free or low-cost terminal options to bypass setup fees.

5. Early Termination Fees

Closing your account before a contract term—often 1-3 years—triggers penalties of $200 to $500 or more, locking you into a processor even if service falters. For startups testing providers or businesses forced to close, this fee is a gut punch, siphoning cash when you need it most. Auto-renewing contracts can trap you further, making flexibility a distant dream.

How to Avoid: Read the fine print before signing—avoid long-term contracts or negotiate month-to-month terms. If stuck, document poor service (e.g., frequent outages) to dispute the fee. Opt for providers with flexible agreements to keep your options open.

Bonus Strategy: Embrace Cash Discounts to Slash Card Fees

Beyond dodging hidden fees, you can actively cut costs with a cash discount program. By offering 3-4% off for cash (or low-cost) payments, you shift card fees to customers who use credit, preserving your margins. For example, a retailer processing $50,000 monthly at 2.9% pays $1,450 in fees. If 30% of customers pay cash with a 3% discount, you save ~$400/month—$4,800 yearly. Ensure clear signage (“Cash saves 3%!”) and compliance with card networks (it’s a discount, not a surcharge). This strategy is gaining traction in 2025 as businesses fight inflation.

Real-World Savings

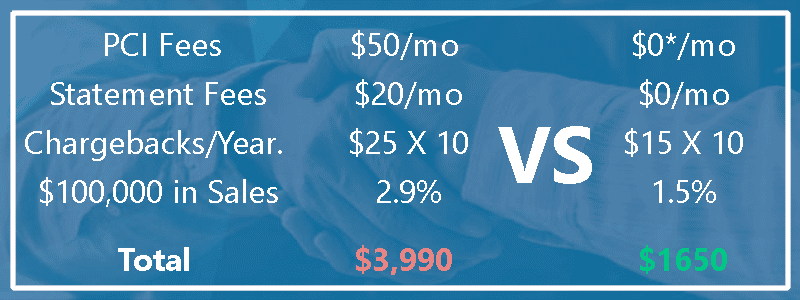

Consider a small boutique hit by $50/mo PCI fees, $20/mo statement fees, and $25 per chargeback (lets say 10/year). That’s $589/year, plus 2.9% on $100,000 in sales ($2,900). Switching to a transparent processor with no PCI/statement fees, lower chargeback costs, and a cash discount program cut their total to $1,500—saving $1,989 annually. They reinvested in marketing, boosting sales 10%. Spotting and dodging fees isn’t just survival—it’s growth.

Leap Payments: Transparency That Saves

Hidden fees don’t have to drain your business. At Leap Payments, we’re committed to helping merchants keep more of their money with transparent pricing and rates lower than big-box processors like Square or PayPal—often 1-2% versus their 2.6-2.9%. Our cash discount program lets you save 3-4% on cash transactions, cutting card fees without hassle. With fast approvals, same-day funding, and free PAX A920 terminals* (*for qualifying merchants), we make processing affordable and reliable—online or in-store. Ready to stop leaks and start saving? Visit LeapPayments.com to see how switching can protect your profits in 2025.

Take Control of Your Costs

Payment processing fees are a silent threat, but they’re not inevitable. By watching for PCI, chargeback, statement, gateway, and termination fees—and using strategies like cash discounts—you can reclaim thousands yearly. Leap Payments is here to make it simple, with clear rates and tools to grow your business, not your expenses.

Contact Us Below & Secure Your Lifetime Rate Lock Today!

Or Call: (800) 993-6300