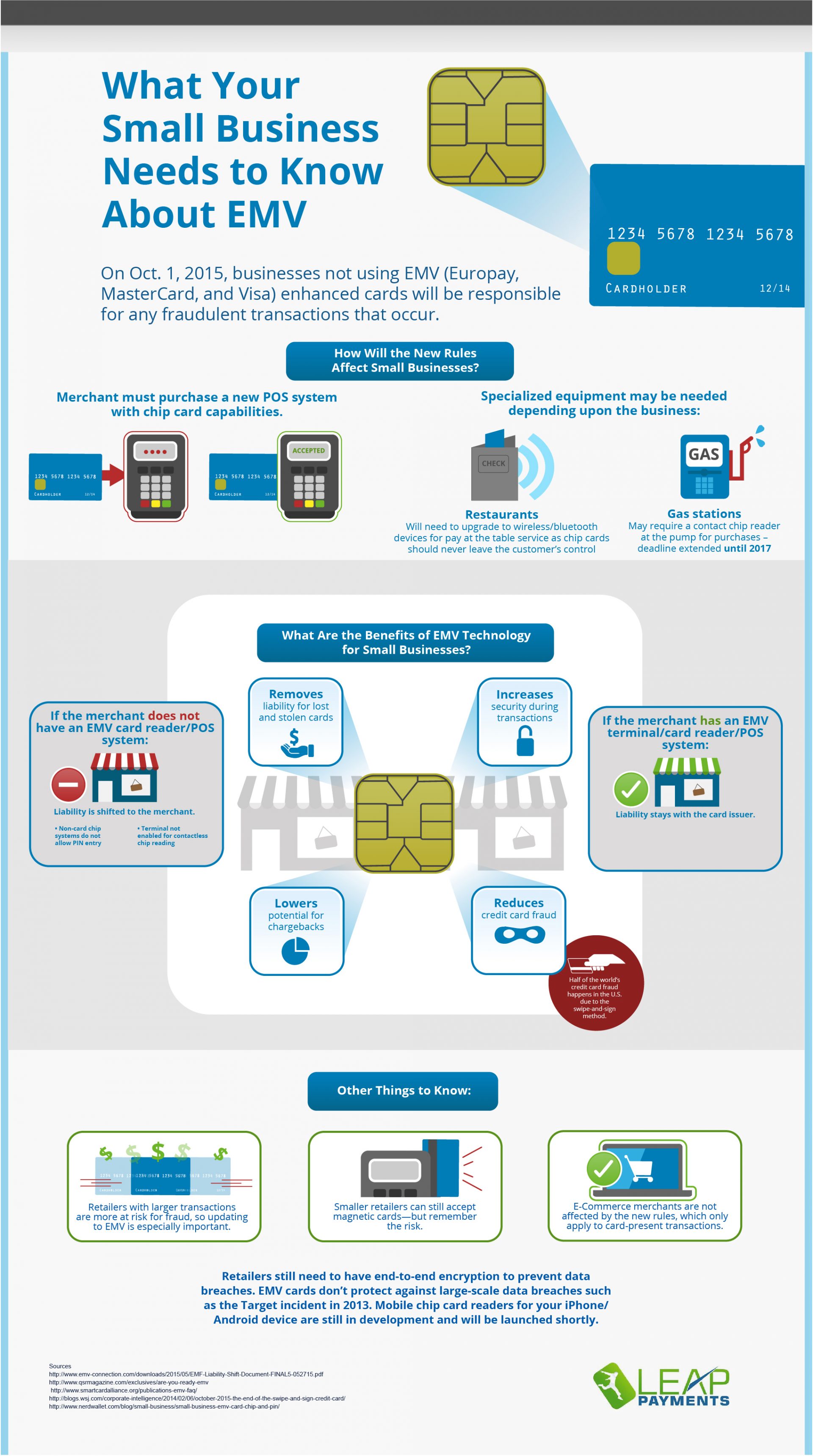

On October 1, 2015, businesses that are not prepared to accept EMV enhanced credit and debit cards as payment will be responsible for any fraudulent transactions that occur. But what is EMV and what do you need to know about the transition as a small business owner? EMV stands for Europay, MasterCard, and Visa, and is the name used for payment cards equipped with a security chip rather than a magnetic stripe.

In order to be in compliance with the rules, merchants must purchase a POS system that has contact chip capabilities to read the new cards. Specialized equipment may be needed depending on the application, which you can learn about by talking to your credit card processing company. EMV technology provides businesses with a range of benefits, including increased security for transactions, reduced fraud, and a lower potential for chargebacks. Investing in EMV readers is especially important for businesses that process larger transactions, since those are more at risk for fraud.

Talk to your merchant account provider about the transition to EMV payment cards to ensure your business is up to speed.

What Your Small Business Needs to Know About EMV

On Oct. 1, 2015, businesses not using EMV (Europay, MasterCard, and Visa) enhanced cards will be responsible for any fraudulent transactions that occur.

How Will the New Rules Affect Small Businesses?

Merchant must purchase a new POS system with chip card capabilities.

Specialized equipment may be needed depending upon the business:

Restaurants

Will need to upgrade to wireless/bluetooth devices for pay at the table service as chip cards should never leave the customer’s control

Gas Stations

May require a contact chip reader at the pump for purchases -deadline extended until 2017

What Are the Benefits of EMV Technology for Small Businesses?

If the merchant does not have an EMV card reader/POS system then liability is shifted to the merchant.

- Non-card chip systems do not allow PIN entry

- Terminal not enabled for contactless chip reading

|

LowersPotential for chargebacks IncreasesSecurity during transactions |

RemovesLiability for lost and stolen cards ReducesCredit card fraud |

If the merchant has an EMV terminal/card reader/POS system then liability stays with the card issuer.

Half of the world, credit card fraud happens in the U.S. due to the swipe-and-sign method.

Other Things to Know:

- Retailers with larger transactions are more at risk for fraud, so updating to EMV is especially important.

- Smaller retailers can still accept magnetic cards—but remember the risk.

- E-Commerce merchants are not affected by the new rules, which only apply to card-present transactions.

Retailers still need to have end-to-end encryption to prevent data breaches. EMV cards don’t protect against large-scale data breaches such as the Target incident in 2013. Mobile chip card readers for your iPhone/Android device are still in development and will be launched shortly.

Sources:

http://www.emv-connection.com/downloads/2015/05/Erv1F-Liability-Shift-Document-FINAL5-052715.pdfhttp://www.gsrmagazine.com/exclusives/are-you-ready-emvhttp://www.smartcardalliance.org/publications-emv-faq/http://blogs.wsj.com/corporate-intelligence/2014/02/06/october-2015-the-end-of-the-swipe-and-sign-credit-card/http://www.nerdwallet.com/blog/small-business/small-business-emv-card-chip-and-pin/