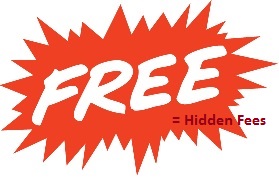

Costs are for “free” are recovered through expensive tiered pricing, annual fees and long term contracts. Since no manufacturer will stay in business if they give away their products someone is covering that cost, in the hopes that they recover that expense and much more. Credit card processing companies will ultimately always make out in the end, so you have to ask yourself if you want to pay for the machine now, or over and over again through higher monthly fees.

After a business has fallen for the free machine marketing ploy, the merchant service processor will also charge a hefty cancellation fee to deter you from leaving also called a liquidated damages clause. They reason that closing your account has caused them material damages, that legally they can recover. And finally another tactic is to require you to return the equipment within 15 days of closing your account or you see a hefty $495 withdrawal from your checking account even if you return the equipment. We’ve heard horror stories of a credit card processing company who on purpose “lose” return shipments so that they can assess these fees.

“Free” can cost a business a ton of money in a very short period of time. While it’s always more tempting to go for free, in this case, paying for the machine will save you more money in the long run. You want to focus your attention on lower costs over the long haul and to know exactly what you are paying.

Remember that all merchant account providers have direct access to your bank account so they can deposit funds and withdraw money just as fast. So wouldn’t you rather just own your new EMV credit card terminal and get away from all of these games?